At the point when Is Rent Guarantee Insurance a Good Idea?

Is it truly that difficult to meet all requirements to lease a loft in huge urban communities? Yes. With a restricted supply of lofts, and the elevated requirements proprietors put on forthcoming tenants, finding the chance to pay thousands every month for what sums to a room and little kitchen can truly feel like a symbol of respect. (For additional, see Renters' Guide: The Rental Process.) These days, in any case, even with sensible resources or a great job, you won't not have the capacity to achieve that objective without gaining a cosigner. Be that as it may, not everyone knows somebody who might will – or qualified – to go up against this part. Enter lease ensure protection.

Lease Guarantee Insurance Can Help

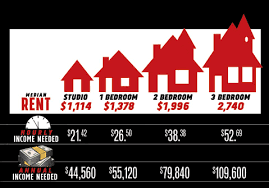

In high-average cost for basic items urban areas, for example, the Big Apple, proprietors routinely request that forthcoming occupants demonstrate a yearly wage of 40 times their month to month lease. That implies that you could need to show wage of more than $158,200 to lease a two-room flat (by and large the month to month rental would be just shy of $3,700), as indicated by a report by Smart Asset. In San Francisco, the report proceeds with, that figure ascends to simply over $216,000 to lease that same two-room loft.

Both of those pay necessities are well over the middle family unit salary of about $56,000. The figures are proportionately swelled (however lower, obviously) for one rooms and even studios.For understudies, singles and those as of now in retirement, meeting the prerequisites to lease is troublesome, and not everybody has somebody both willing and fit the bill to cosign for them or assurance the lease. That is the place lease ensure protection comes in. Purchasing this protection gives an organization that can go about as an underwriter and support a leaseholder's odds of being endorsed by a landowner or administration organization.

How it Works

Landowners would prefer not to take the risk that their inhabitants will quit paying. Lease ensure protection resemble having a cosigner. On the off chance that you quit paying, there's an organization backing you that needs to begin making installments in your place. You pay an expense for one of these organizations – Insurent.com and TheGuarantors are two illustrations – to serve as the underwriter – a favor term for a cosigner with more profound pockets. You can't simply cruise in and join, notwithstanding. Generally as you would with a landowner, lease ensure back up plans will require qualifying data, for example, a financial assessment that is above 630 and a yearly salary that is no less than 27 times your month to month lease. On the off chance that you don't meet those capabilities, the way it was done in the good 'ol days of utilizing a cosigner may help you fit the bill for an underwriter. (Yes, the cosigner needs a cosigner.)

What amount?

The question you're most likely asking is "What amount does it cost?" For TheGuarantors, plan to pay 5% to 7% of the yearly lease contingent upon your FICO assessment. In case you're sufficiently fortunate to discover a loft in New York City for $1,500 a month, the cost will be as much as $1,260, payable in one single amount – fundamentally comparable to one month's lease. You're likely considering, "I as of now need to pay the first and a month ago's lease, and now I need to pay what might as well be called one more month for lease ensure protection?" Unfortunately, the answer is yes. A few organizations promote the charges in an unexpected way, however they're truly near the same. Insurent, for instance, charges 80% to 90% of a month's lease or up to $1,350 (again in light of a $1,500 a month lease). Remote inhabitants will pay more for the protection.

Would it be advisable for me to Use it?

Unless you have a high salary, or a cosigner in your back pocket, you might not have a decision. Contingent upon your pay and FICO rating, landowners can require it as a major aspect of the endorsement procedure. Somewhere in the range of occupants even get prequalified, so they can indicate scope as a component of their application bundle. Over and over again it's costly however inescapable.

Do All Landlords Accept It?

No. They need to enroll their working with the insurance agency, yet that takes under 48 hours much of the time. For whatever length of time that the proprietor consents to acknowledge the certification, you're secured.

Most dire outcome imaginable

What happens on the off chance that you quit paying your lease? All things considered, recall, this scope isn't for you; it's for the landowner. On the off chance that you quit paying, the underwriter will venture in and make a specific number of installments and afterward come after you, generally as your proprietor would. At the end of the day, on the off chance that you quit paying, despite everything you'll be expelled, regardless you'll see your financial assessment fall, and you'll begin getting calls from obligation authorities pretty much as you would with some other terrible obligation.